Payroll Manager: We are a new organization which is defining the business rules for its payroll process. Our organization’s pay period is monthly, and we would like to define our pay period as the length of time from the 21st of a calendar month to the 20th of the next calendar month.

Hinote: When do you plan to make the salary payment each month?

Payroll Manager: We would like to make salary payments on the last day of each calendar month, for the month ended the previous 20th.

Hinote: Why have you defined the pay period as 21st to 20th?

Payroll Manager: In our industry, many employees quit their organization abruptly, without providing notice to their employer. By paying salary on the last day of a calendar month, we would be able to “retain” about 10 days’ (from 21st till the day salary is paid) salary.

We believe this would discourage employees from leaving our organization without providing any notice (since their 10 days’ salary would be with the company).

What is your view on this?

We find that the most frequently used pay period (the period of time for which salary is paid), at least in the organized sector in India, is monthly.

According to Section 4 of the Payment of Wages Act, 1936, one of the relevant statutes governing salary payments,

4. Fixation of wage-periods

(1) Every person responsible for the payment of wages under section 3 shall fix periods (in this Act referred to as wage-periods) in respect of which such wages shall be payable.

(2) No wage-period shall exceed one month.

There isn’t a single statute which governs fixation of pay period and deadline for salary payments in India. The Payment of Wages Act, 1936, covers only certain categories of organizations and employees. As you would be aware, Labour is in the Concurrent List of the Indian constitution. One may also have to look at state-level legislations such as The Shops and Establishments Act while determining the relevant statute related to pay period for a particular organization.

The Payment of Wages Act states that the maximum pay period cannot be more than a month. Other statutes such as The Shops and Establishment Act too state that a single pay period cannot be greater than one month.

Some organizations define “month” as calendar month, while other organizations specify their own dates to define month – for example, from the 21st of a calendar month to the 20th of the next calendar month.

If an organization chooses month as pay period for salary, which is better between the following options? Should month be defined as calendar month or can it be a period of time, say, from the 21st of a calendar month to the 20th of the next calendar month?

In our view, defining month as anything other than calendar month leads to problems in salary processing and statutory compliance. It is best if month is defined as calendar month whenever salary is paid monthly.

Let us take a look at the problems faced by payroll managers when they define their own month (instead of calendar month) for salary calculation.

Difficulty in salary calculation

When the pay period is spread across 2 calendar months, what should the base days for pay computation be? For example, should pay be computed for 26 or 30 days? We discussed the superiority of calendar day logic (over using a fixed number of days such as 26 or 30) for pay calculation in an earlier blog post. The calendar day logic will not work if the salary month is different from calendar month.

Of course, one can use the exact number of worked days for an employee and the total number of pay days (say, 26 or 30) and calculate pay, if the salary month is defined as 21st to 20th or 26th to 25th for that matter. However, in such cases, implementing an automated salary arrear calculation, by way of a business rule in the payroll software that you may be using, may not be possible and the payroll manager adopting 21st to 20th as the salary month may have to compute arrear salary manually. In addition, usage of non-calendar salary months may lead to incorrect computation of loss of pay amounts and loss of pay reversal amounts.

Problems with income tax calculation

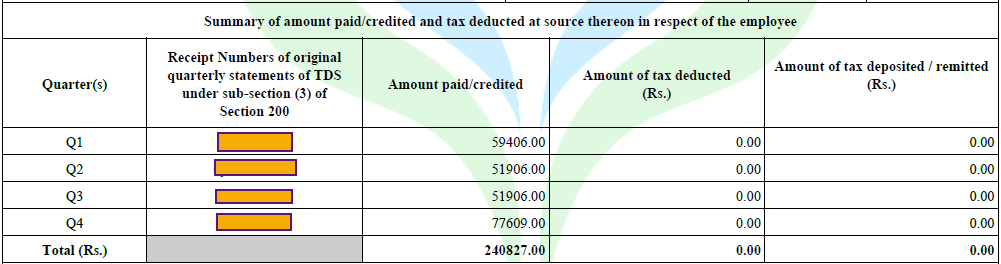

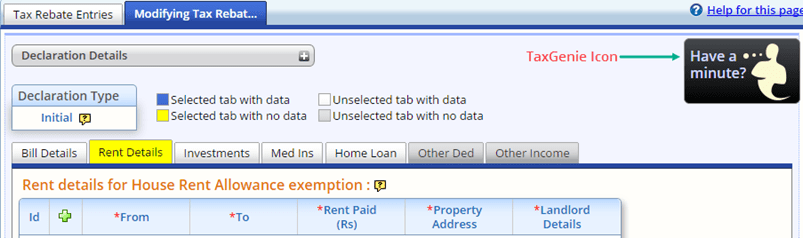

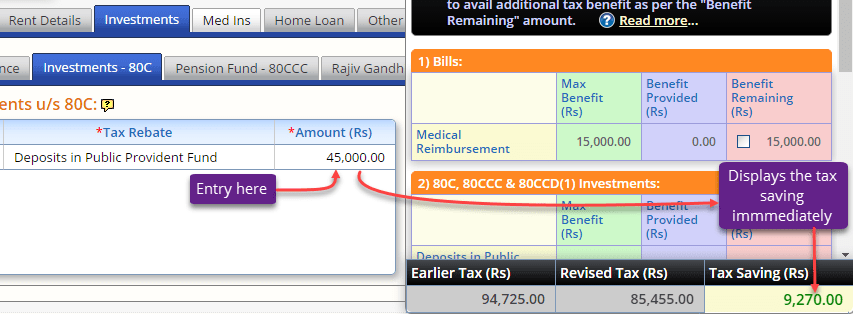

The tax year is from April 1 to March 31 as per the Income Tax Act. If a company defines its pay period as, say, 21st to 20th, compliance with the tax law may be difficult. In the month of March, the company’s salary month would end on March 20 (for the month February 21st to March 20th). If salary for the period from March 21st to March 31st accrues in the books of accounts of the company for the month of March, the company will have to calculate income tax on salary for that period as per the tax rates prevailing for the year ending March 31. If for the salary paid for the period from March 21 to April 20, tax rates are applied as per the rates prevailing in the new tax year starting April 1, the company may be calculating tax in contravention to Section 15 of the Income Tax Act. As a consequence, Form 16 issued to employees may present incorrect data regarding salary paid and income tax deducted.

Problems with PF/ESI calculation

The term month, for all practical purposes, refers to calendar month, when it comes to Provident Fund (PF) and Employee State Insurance (ESI) calculations. If a company follows 21st to 20th as salary month, the amount remitted to the PF/ESI department may be different from the PF/ESI amount which should be accrued in the books of accounts since the PF/ESI amount for a calendar month could be different from the PF/ESI amount payable for the salary month, from 21st to 20th.

If new PF or ESI deduction rates are mandated by the respective departments from a certain month, computation of PF/ESI deductions may be incorrect if an organization follows non-calendar month for pay computation. For example, let us assume that a new PF deduction rate, say, 15% of Basic wages comes into effect from March 1 of a PF year. If an organization follows February 21 to March 20 as the salary month, the PF amount for salary paid for Feb 21 to Feb 28 may be calculated at 15% (the new rate) in March payroll run while the new PF rate comes into existence only from March 1 (and not February 21).

Our discussion with the payroll manager (referred to at the beginning of this post) ended as follows.

Hinote: So, for the above reasons, we recommend that you define pay period as calendar month for your organization.

Payroll Manager: Sounds good. But what about employees leaving our organization as soon as they draw their salary, without any notice – the problem I mentioned at the beginning of this blog post? How can we hold back some of their salary to ensure that they do not leave without adequate notice?

Hinote: The statutes governing pay period for salary (Payment of Wages Act, The Shops and Establishments Act, etc.) require employers to make salary payments within a certain number of days after the end of a pay period. Your organization can hold salary back only until the period specified in law. For example, if your organization is covered under The Shops and Establishments Act (S & E) and if the S & E Act in your state requires you to make the salary payment within 7 days from the end of a pay period, you could wait until that time to pay the salary. For example, for the pay period pertaining to calendar month ending, say, June 30, you need to pay the salary on or before the 7th of July, in this case. Hence, the salary for the period from the 1st of July to the 7th of July can be considered as the “held back” salary.

Please note that your organization needs to adopt the correct legal procedures with regard to dealing with an employee who leaves without any notice. No organization cannot hold back any salary payable to an employee just on the basis of its whims and fancies.

Read more